11 Mar Real Estate Market February 2025

Your February 2025 real estate market update is here! Covering Toronto, Oakville, Burlington, Hamilton and the surrounding areas.

Highlights of the real estate market from TREBB and RAHB

“Home buyers continued to benefit from substantial choice in the Greater Toronto Area (GTA) resale market in February 2025. Home sales last month were down in comparison to the same period last year, while listing inventory remained high, providing substantial negotiating power for homebuyers.

“Many households in the GTA are eager to purchase a home, but current mortgage rates make it difficult for the average household income to comfortably cover monthly payments on a typical property. Fortunately, we anticipate a decline in borrowing costs in the coming months, which should improve affordability,” said TRREB President Elechia Barry-Sproule.

“On top of lingering affordability concerns, home buyers have arguably become less confident in the economy. Uncertainty about our trade relationship with the United States has likely prompted some households to take a wait and see attitude towards buying a home. If trade uncertainty is alleviated and borrowing costs continue to trend lower, we could see much stronger home sales activity in the second half of this year,” said TRREB Chief Market Analyst Jason Mercer.

GTA REALTORS® reported 4,037 home sales through TRREB’s MLS® System in February 2025 – down by 27.4% compared to February 2024. New listings in the MLS® System amounted to 12,066 – up by 5.4% year-over-year. On a seasonally adjusted basis, February sales were down month-over-month compared to January 2025.

The MLS® Home Price Index Composite benchmark was down by 1.8% year-over year in February 2025. The average selling price, at $1,084,547, was down by 2.2% compared to the February 2024. On a month-over-month basis, the MLS® HPI Composite and the average selling price edged lower after seasonal adjustment.”

Over in the Hamilton-Burlington area: “Sales decreased 35% year-over-year, reaching the lowest total for the month of February since 2009. However, new listings showed a more modest decline of 9%, which aligns with the month’s long-term averages. While sales slowed across all regions, Burlington experienced the most significant change. However, it will take some time to determine whether this is a trend or a one-off, as Burlington has held steady over the past few years. Despite these fluctuations, the market is showing signs of stabilizing and adjusting to long-term trends.

“Although the market looks different than what we have experienced the past few years, inventory and benchmark prices reflect a more stable market that is in alignment with long-term trends,” says Nicolas von Bredow, Cornerstone spokesperson for the Hamilton-Burlington market area. “Buyers and sellers are able to make more thoughtful decisions, which presents a real opportunity to find a great property.”

Compared to the decline in sales, the more modest decrease in new listings has helped inventory levels rebound, increasing by 28%. Inventory levels reached 2,599 units—the highest February inventory total since 2013. This boost in inventory also led to an increase in months of supply, which reached 4.5 months. This is nearly double the supply seen at this time last year, and it’s also the second-highest February total on record.

Increased options and the sharp decline in sales put downward pressure on pricing. The regional benchmark price dropped by 3% to $812,600. Unlike in January, prices declined across all property types and regions, with the most significant price decreases experienced in the semi-detached and row sectors. It will take time to determine if this is the calm before a hot spring market or a longer-term trend.

Questions about buying or selling? Reach out anytime, I’d be happy to discuss the market with you!

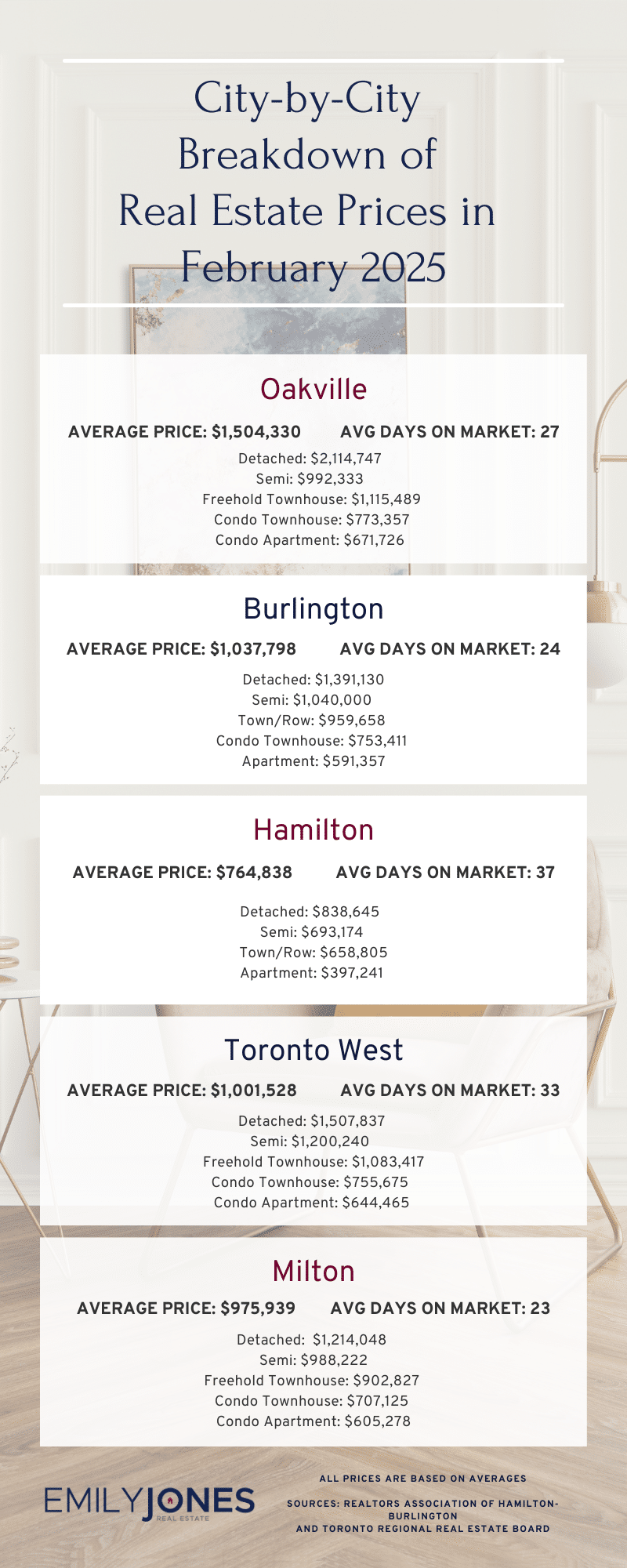

All the latest home prices and statistics by property type and city below!

Burlington

Average Sale Price: $1,037,798 compared to $1,108,409 last month

Average Days on Market: 24 days

Detached: $1,391,130 (vs January 2025 $1,532,984)

Semi: $1,040,000 (vs January 2025 $897,667)

Town/Row: $959,658 (vs January 2025 $938,556)

Condo Townhouse: $753,411 (vs January 2025 $898,417)

Apartment: $591,357 (vs January 2025 $656,207)

Hamilton

Average Sale Price: $764,838 compared to $757,071 last month

Average Days on Market: 37 days

Detached: $838,645 (vs January 2025 $836,338)

Semi: $693,174 (vs January 2025 $649,209)

Town/Row: $658,805 (vs January 2025 $677,501)

Apartment: $397,241 (vs January 2025 $455,014)

Oakville

Average Sale Price: $1,504,330 compared to $1,352,531 last month

Average Days on Market: 27 days

Detached: $2,114,747 (vs January 2025 $1,853,519)

Semi: $992,333 (vs January 2025 $1,227,317)

Freehold Townhouse: $1,115,489 (vs January 2025 $1,220,150)

Condo Townhouse: $773,357 (vs January 2025 $787,058)

Condo Apartment: $671,726 (vs January 2025 $789,745)

Mississauga

Average Sale Price: $1,039,951 compared to $1,047,025 last month

Overall Average Days on Market: 28 days

Detached: $1,606,875 (vs January 2025 $1,596,150)

Semi: $992,191 (vs January 2025 $1,047,977)

Freehold Townhouse: $983,833 (vs January 2025 $991,557)

Condo Townhouse: $781,259 (vs January 2025 $804,888)

Condo Apartment: $581,431 (vs January 2025 $601,119)

Toronto West

Average Sale Price: $1,001,528 compared to $942,296 last month

Average Days on Market: 33 days

Detached: $1,507,837 (vs January 2025 $1,380,750)

Semi: $1,200,240 (vs January 2025 $1,027,567)

Freehold Townhouse: $1,083,417 (vs January 2025 $1,078,750)

Condo Townhouse: $755,675 (vs January 2025 $834,976)

Condo Apartment: $644,465 (vs January 2025 $651,229)

Milton

Average Sale Price: $975,939 compared to $1,038,619 last month

Average Days on Market: 23 days

Detached: $1,214,048 (vs January 2025 $1,339,337)

Semi: $988,222 (vs January 2025 $1,019,900)

Freehold Townhouse: $902,827 (vs January 2025 $907,864)

Condo Townhouse: $707,125 (vs January 2025 $645,667)

Condo Apartment: $605,278 (vs January 2025 $650,735)

Sources for Real Estate Market Update for January 2025 : Toronto Regional Real Estate Board and REALTORS® Association of Hamilton-Burlington